irs child tax credit problems

That translates to 250 per month. Ad The 2021 advance was 50 of your child tax credit with the rest on the next years return.

Child Tax Credit 2021 What To Do If You Didn T Get A Payment Or Got The Wrong Amount Cbs News

To be a qualifying child for the 2021 tax year your dependent generally must.

. 2021 Tax Filing Information Get your advance payments total and number of qualifying children in your online account and in the Letter 6419 we mailed you. That means if a five-year-old turns six in on or before December 31 2021 the parents will receive a total Child Tax Credit of 3000 for the year not 3600. For parents of children up to age five the IRS will pay 3600 per child half as six monthly payments and half as a 2021 tax credit.

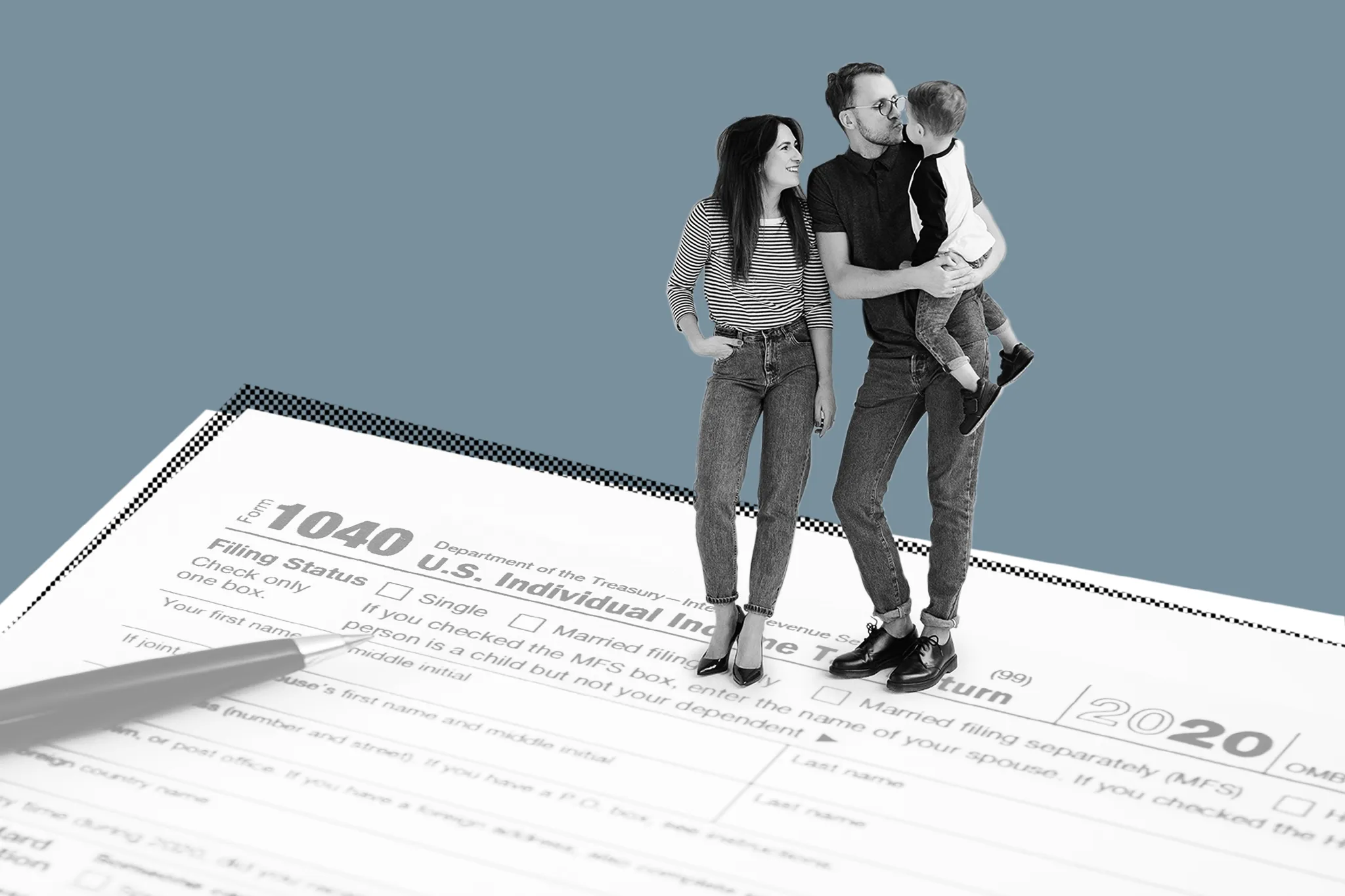

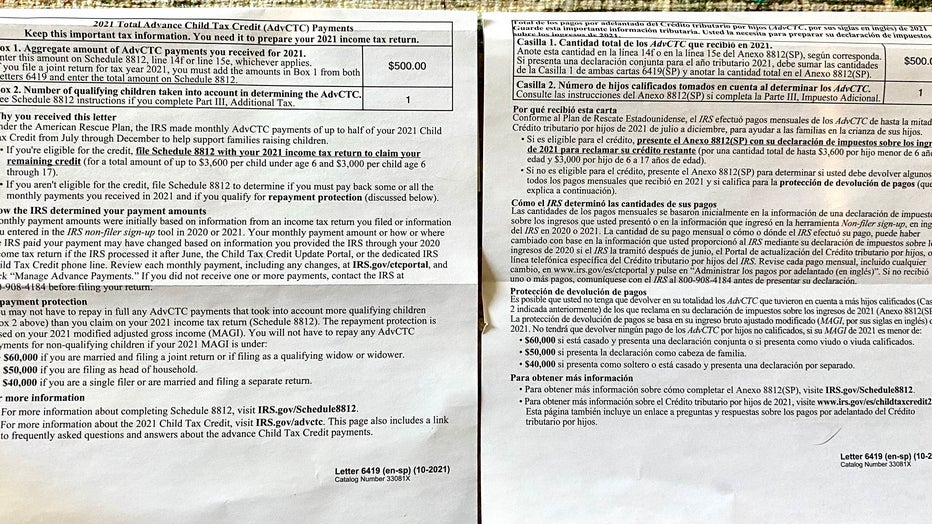

IRS Admits Errors in Child Tax Credit Letters Sent to Taxpayers. It will show the amount of advance child tax credit that you received during 2021. IThe IRS phone lines are expected to continue to be jammed and difficult to get through Rettig said on the call Monday.

If you have children and received child tax credit payments in 2021 youll need a Letter 6419 from the IRS to complete your tax filing reconciling the amounts received with what you were eligible for. File a federal return to claim your child tax credit. You can also claim missing payments on your next tax return.

The current changes to the 2021 child tax credit made the credit 3600 for children under age 6 and let families qualify if they have little or no income. This story is part of Taxes 2022 CNETs coverage of the best tax software and everything else you need to get your return filed quickly accurately and on-time. The remaining amount of CTC that you can receive will show up on line 28 of your 2021 Form 1040.

RAISE Texas and BakerRipley are two non-profits helping people get their child tax credit payments. You can no longer view or manage your advance Child Tax Credit Payments sent to you in 2021. That comes out to 300 per month and 1800 at tax time.

Well continue to update this story as. The expanded child tax credit for. FederalDeductions and CreditsYou and Your FamilyChild Tax Credit.

Be your son daughter stepchild eligible foster child brother sister. The IRS says theyve. Enter the information from that letter carefully.

Last year the IRS received more than 100 million phone calls to its. The number to call the IRS regarding Child Tax Credit Payments is 866 682-7451. The Child Tax Credit Update Portal is no longer available.

You can claim the Child Tax Credit for each qualifying child who has a Social Security number that is valid for employment in the United States. The IRS has mailed out Letter 6419 but now says some of them are wrong. A group of parents who received their July payment via direct deposit will receive.

Simple or complex always free. If you have not received payment after that time you can file a payment trace by filing IRS form 3911. The IRS announced a technical issue that could affect up to 15 percent of recipients of the Child Tax Credit.

The IRS is sending out letter 6419 to you. TAdmitting that they expect another chaos-filled filing season Treasury and the IRS have been encouraging taxpayers who received advance payments of the Child Tax Credit CTC to watch for Letter. Be under age 18 at the end of the year.

9 Reasons You Didn T Receive The Child Tax Credit Payment Money

Irs Releases Draft Form 1040 Here S What S New For 2020 Irs Forms Income Tax Return Irs

Haven T Received Your Advance Payment Of The Child Tax Credit Issued To You Yet

Stimulus Update What To Do If A Child Tax Credit Check Is Stolen Or Lost

2021 Child Tax Credit Advanced Payment Option Tas

How To Call The Irs With Tax Return And Child Tax Credit Questions Cnet

Irs Cp 08 Potential Child Tax Credit Refund

Irs Offers New Details On Glitch That Delayed Child Tax Credits Top Stories Nny360 Com

Child Tax Credit Update How To Change Your Bank Info Online Money

Did Your Advance Child Tax Credit Payment End Or Change Tas

Advance Child Tax Credit Filing Confusion Cleared Up

September Child Tax Credit Payments How To Fix Mistakes Money

Irs Notice Cp79 We Denied One Or More Credits Claimed On Your Tax Return H R Block

Child Tax Credit Dates As Irs Set To Send Out New Payments

Stimulus Update Here S What To Do If There S A Problem With Your Child Tax Credit Letter

/cloudfront-us-east-1.images.arcpublishing.com/gray/4WFOZIVSSRDMLDJEBJZAF3BNF4.jpg)

Stimulus Update Child Tax Credit Payments To Start Hitting Bank Accounts Thursday

Tax Tip Returning A Refund Eip Or Advance Payment Of The Ctc Tas

Child Tax Credit Update What Is Irs Letter 6419 Gobankingrates

Late Child Tax Credit Payments From Irs Arriving Now Fingerlakes1 Com